- Chart Art

- Posts

- Chart Art: Oct 23, 2025

Chart Art: Oct 23, 2025

The best charts and trade ideas from the day.

STOCKTWITS CHART ART

The Stocktwits Summary 📝

The market rebounded from mid-week lows Thursday, after clarification that Trump and Xi will meet next week, and rumors Uncle Sam might buy some quantum stocks.

Here’s how the major indexes ended the day:

Index | ST Sentiment Score |

|---|---|

Extremely Bearish (22) | |

Extremely Bearish (21) | |

Bearish (31) | |

Extremely Bearish (22) |

*The ST Sentiment Score & Message Volume scales range from 0 to 100 (extremely bearish to extremely bullish). More info here.

Email me (Kevin Travers) with charts! Message me charts @kevinbtravers

CHART OF THE DAY

TSLA Weekly Ascending Channel Holds As Bulls Defend $448 And Momentum Stays Intact ⚡

SPONSORED

2022-2025 market had it all. What worked best?

From the 2022 drawdown to the AI melt-up, plus rate shocks and headline whiplash, one pattern kept showing up in our tests: returns favored process over prediction. The portfolios that held up best shared four traits:

Neutral beta: long strength, short weakness so index direction mattered less.

Volatility-based sizing: cut tail risk instead of chasing bigger bets.

Hedge & correlation control: cap exposure when regimes flip.

Disciplined rebalance: lock in edges, avoid drift.

We ran 758,202 backtests across 1,741 stocks and multiple regimes. The result is a rules-based market-neutral system aimed at steadier equity curves and smaller drawdowns—in under an hour a week.

Want the simple, step-by-step breakdown?

Past performances don't guarantee future returns. Visual Sectors provides data and backtest results, not financial advice or money management

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

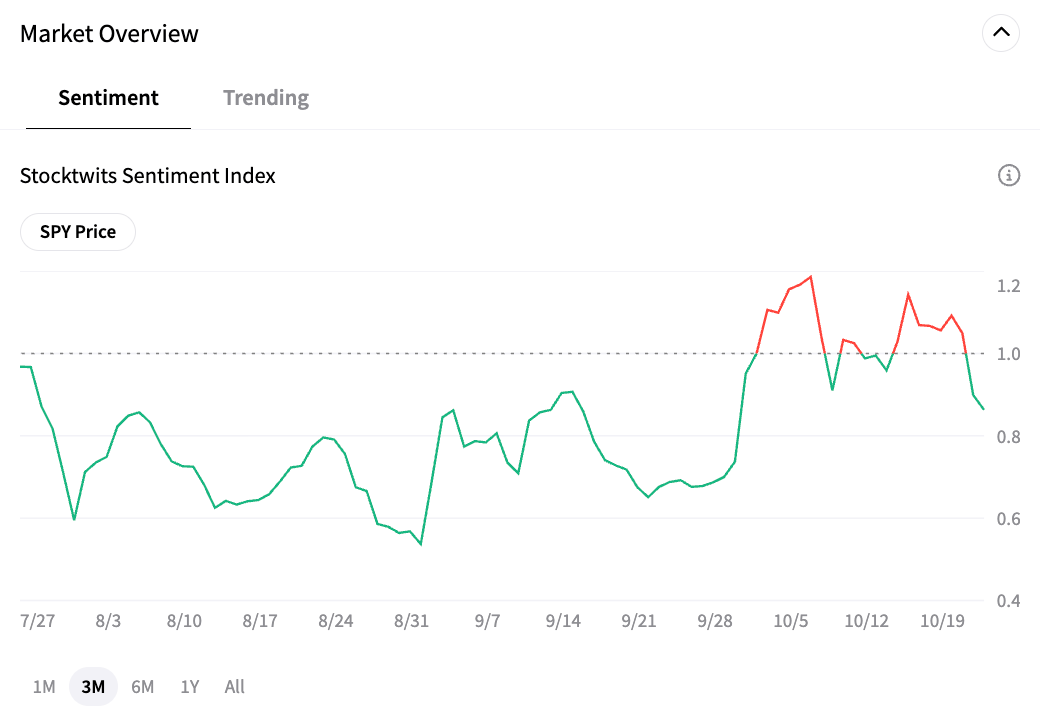

STOCKTWITS SENTIMENT INDEX

How Is The Market Feeling? 👀

CLSK Inside Candle Forms At High-Volume Node As Bulls Eye Continuation Setup ⚡

Get In Touch 📬

How did we do toady? |

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach thousands of chart enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋