- Chart Art

- Posts

- Fri, Nov 21, 2025

Fri, Nov 21, 2025

The best charts and trade ideas from the day.

STOCKTWITS CHART ART

The Stocktwits Summary 📝

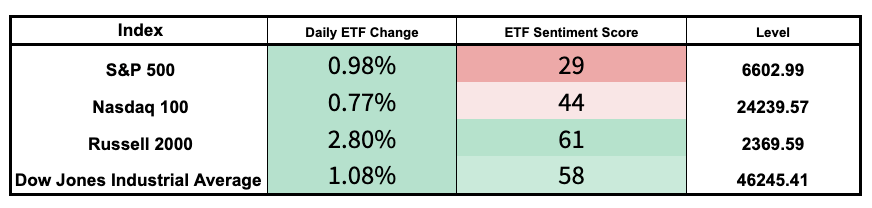

Well, now that trading is closed, it is safe to say the market was green Friday, pulling out of a nose-dive post Nvidia earnings that saw choppy trade all morning. Every single sector closed in the green, after a market reaction to an earnings beat that made us all look like fools for believing AI stocks could climb forever. It feels like the Trump team leaked rumors they were ‘considering letting Nvidia sell H200 chips to China’ just to restart the AI stock boost. Nvidia has said that could be a $50B move.

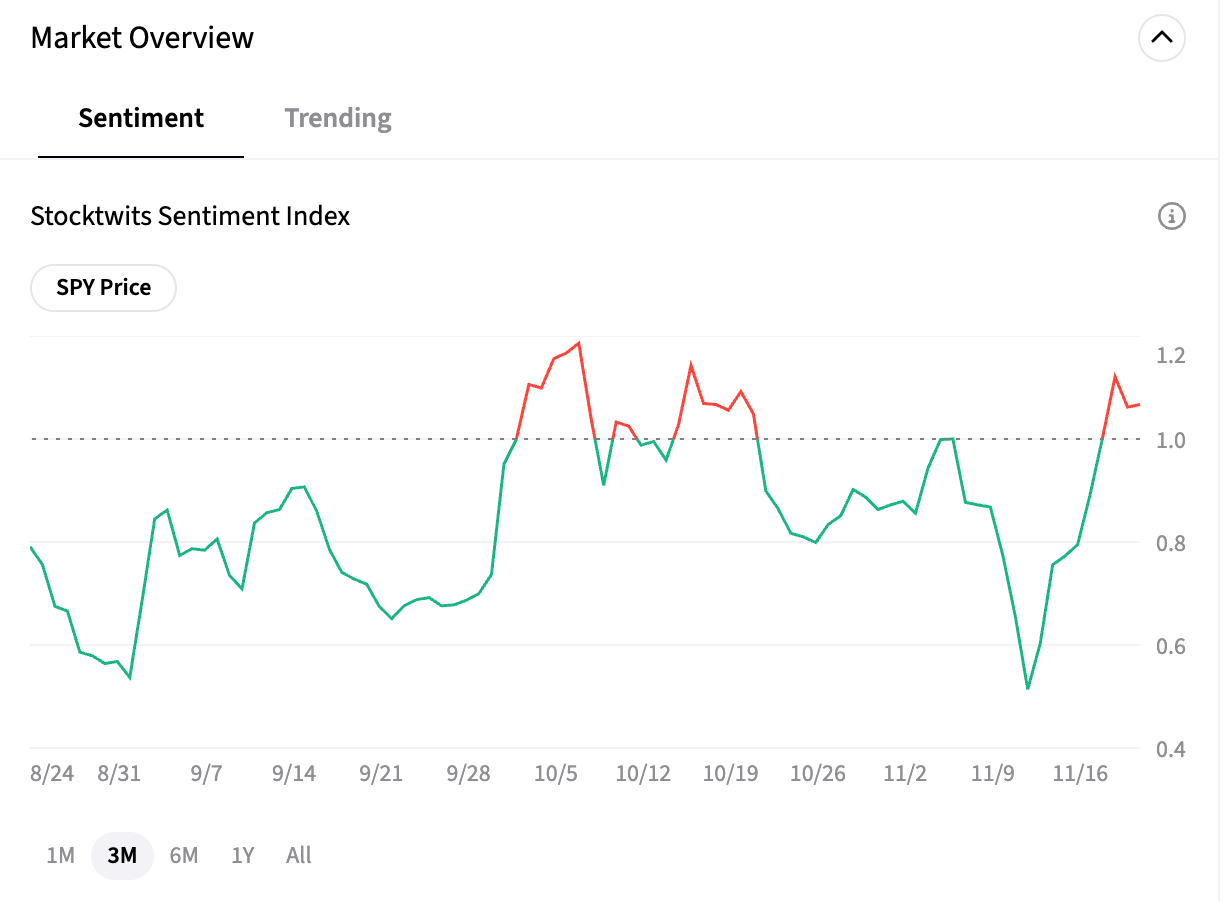

*The ST Sentiment Score & Message Volume scales range from 0 to 100 (extremely bearish to extremely bullish). More info here.

Email me (Kevin Travers) with charts! Message me charts @kevinbtravers\

CHART OF THE DAY

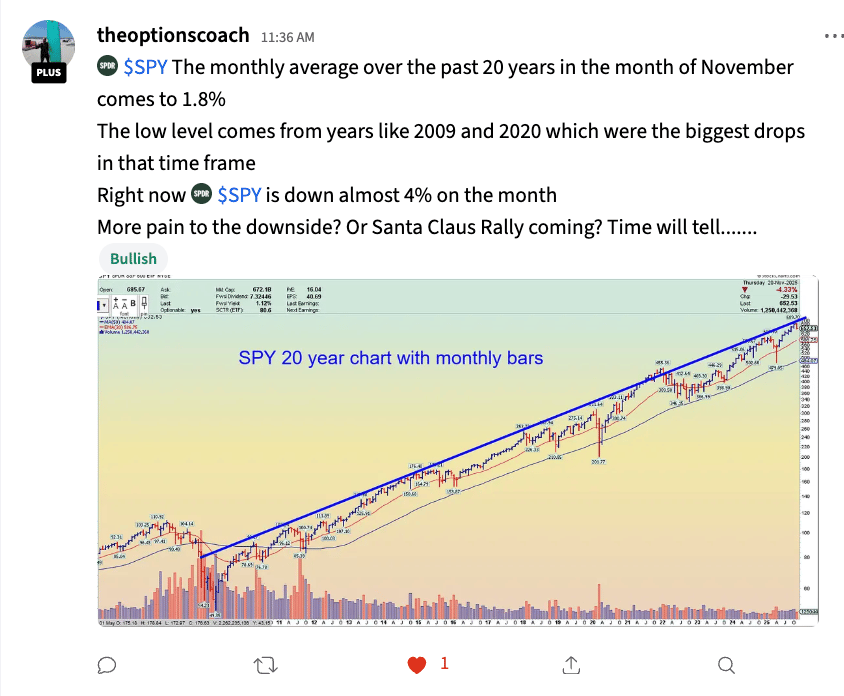

SPY Down Nearly 4% In November vs 20-Year Avg Gain of 1.8%, Testing Seasonal Lows From 2009 & 2020 🎄

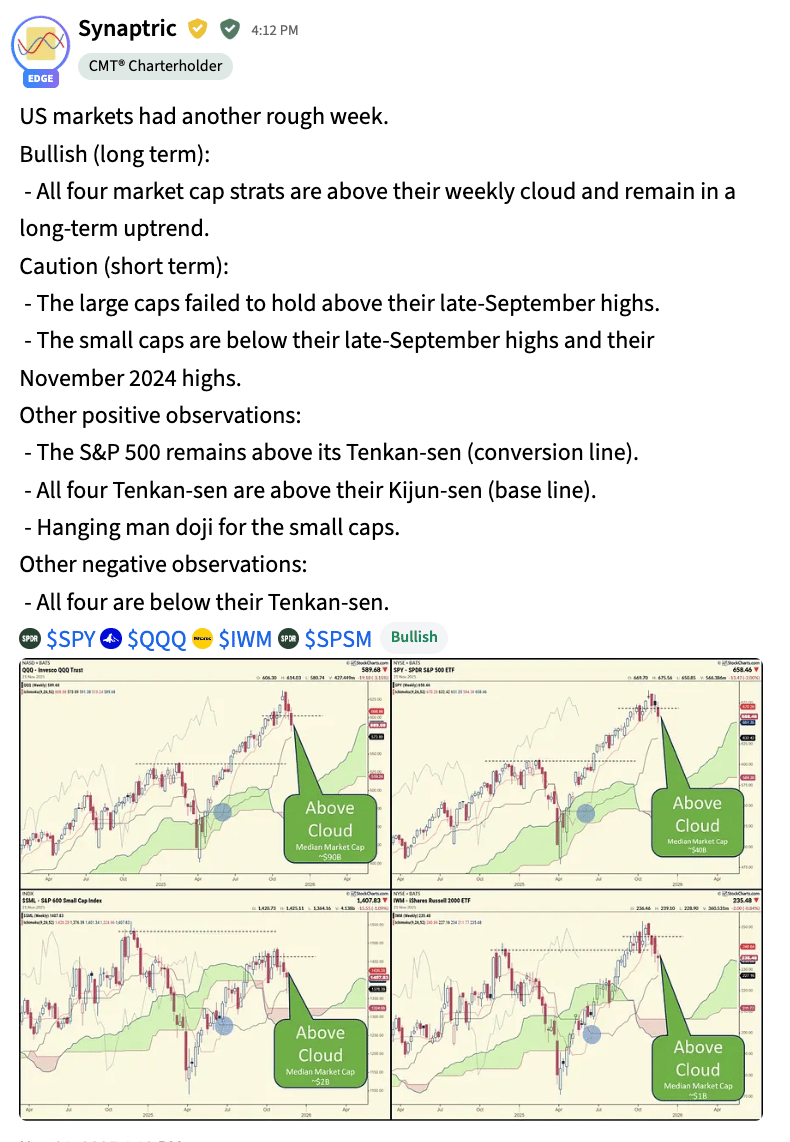

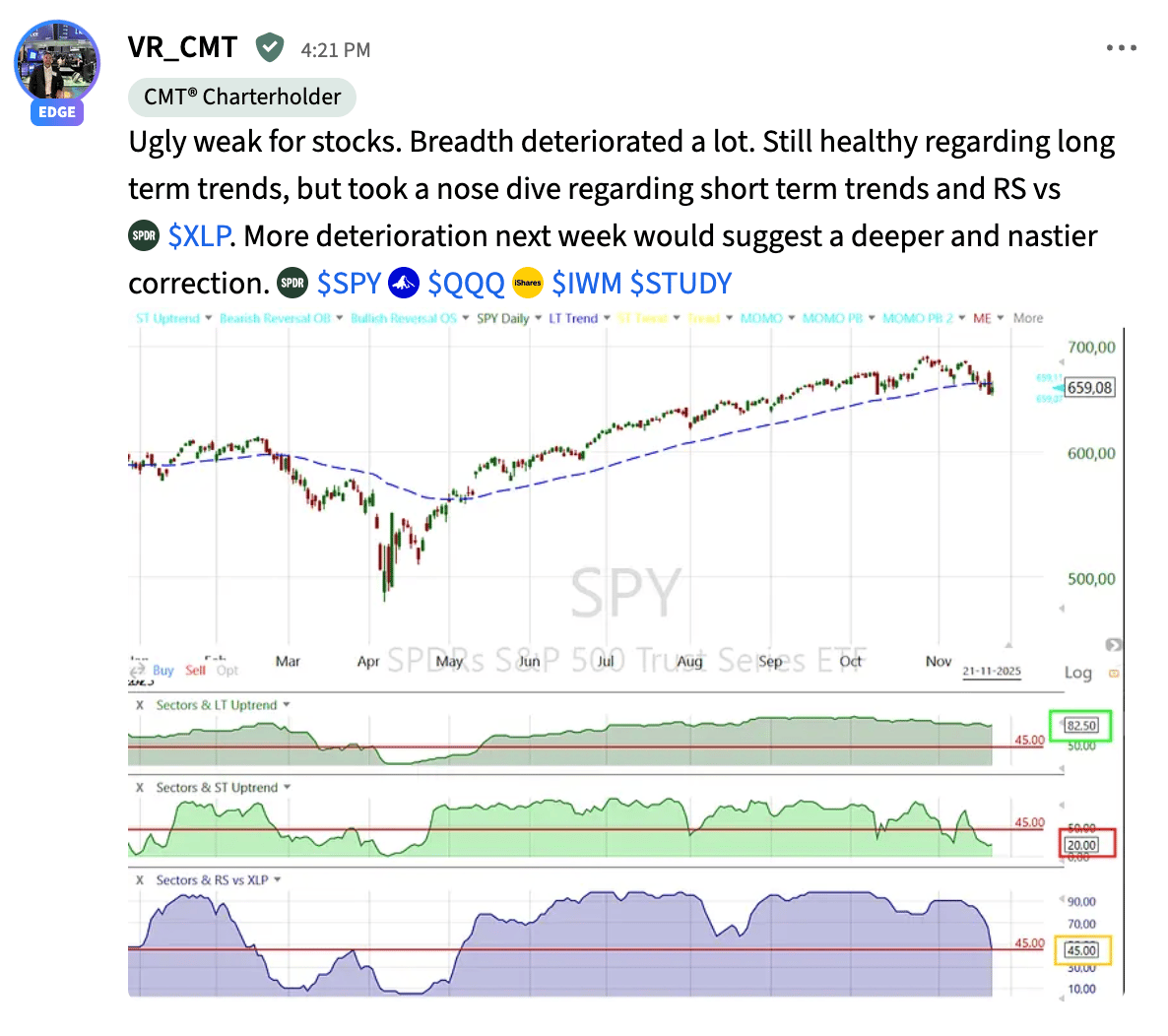

SPY, QQQ, IWM, SPSM All Hold Above Weekly Cloud But Fail September Highs—Short-Term Caution Amid Long-Term Bull Trend 🌫️

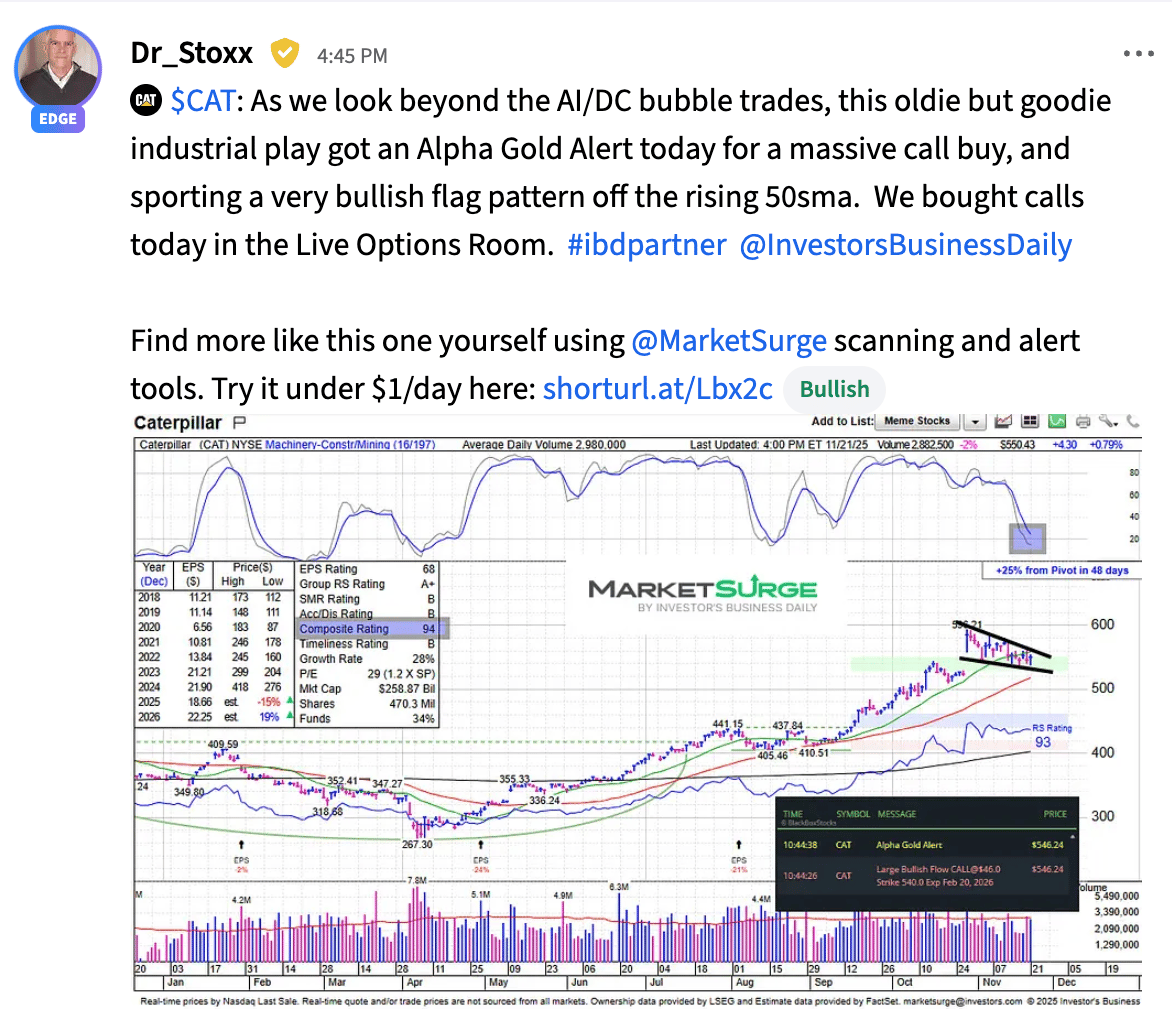

CAT Flags Bullish Continuation Off Rising 50SMA As Alpha Gold Alert Triggers Massive Feb Call Flow 🏗️

SPONSORED

Find VCP Breakouts in Strong, Healthy Uptrends

What once took hours now takes seconds. Combine VCP candle patterns with the 10-Point Trend Template popularized by Mark Minervini to find true market leaders in strong, healthy uptrends.

This VCP collection makes the process simple. Candles grade every bar against the Trend Template. Scans surface coiling VCP setups and fresh breakouts in real time, filtered for names in perfect Trend Template alignment.

Try TrendSpider for $0.50 a day, then save up to 68% during Black Friday when you sign up. Get a free bonus offer too!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKTWITS SENTIMENT INDEX

How Is The Market Feeling? 👀

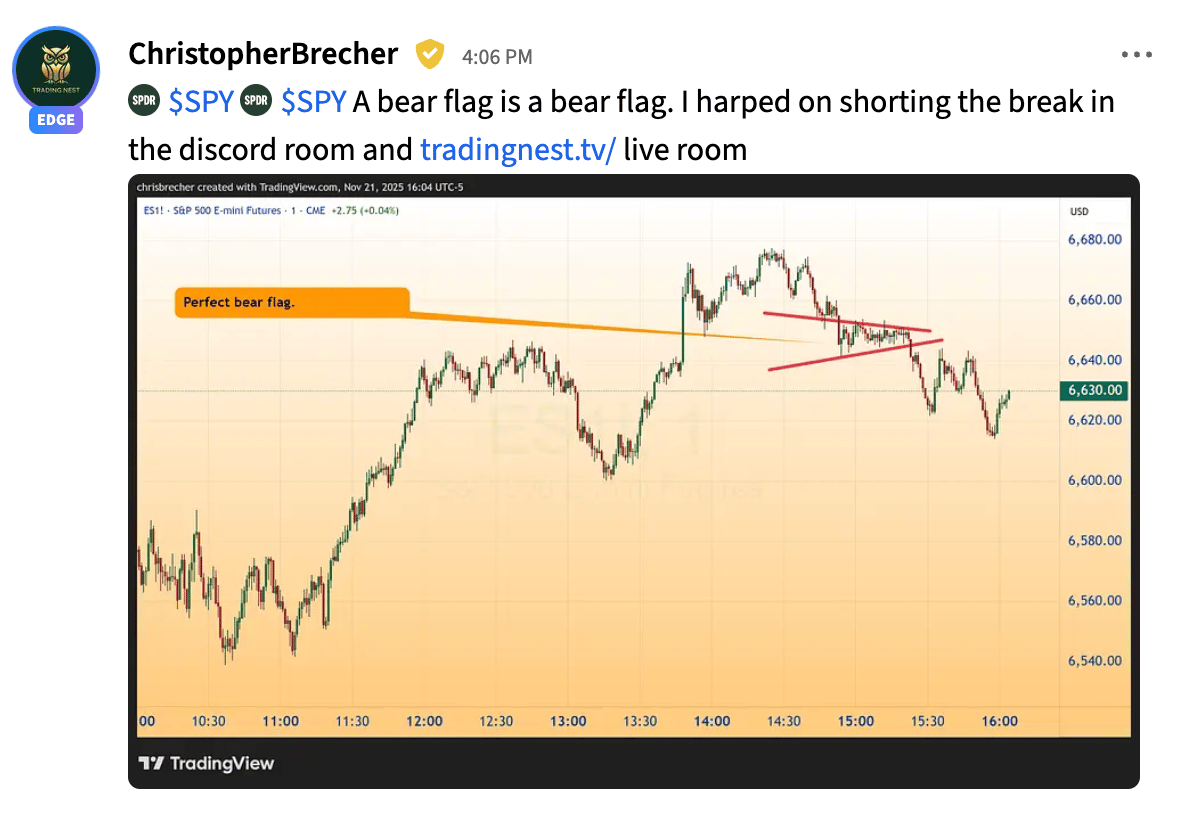

EMini Futures Break Bear Flag With Sharp Intraday Drop, Discord Traders Nail Short Entry On Pattern Confirmation 🧨

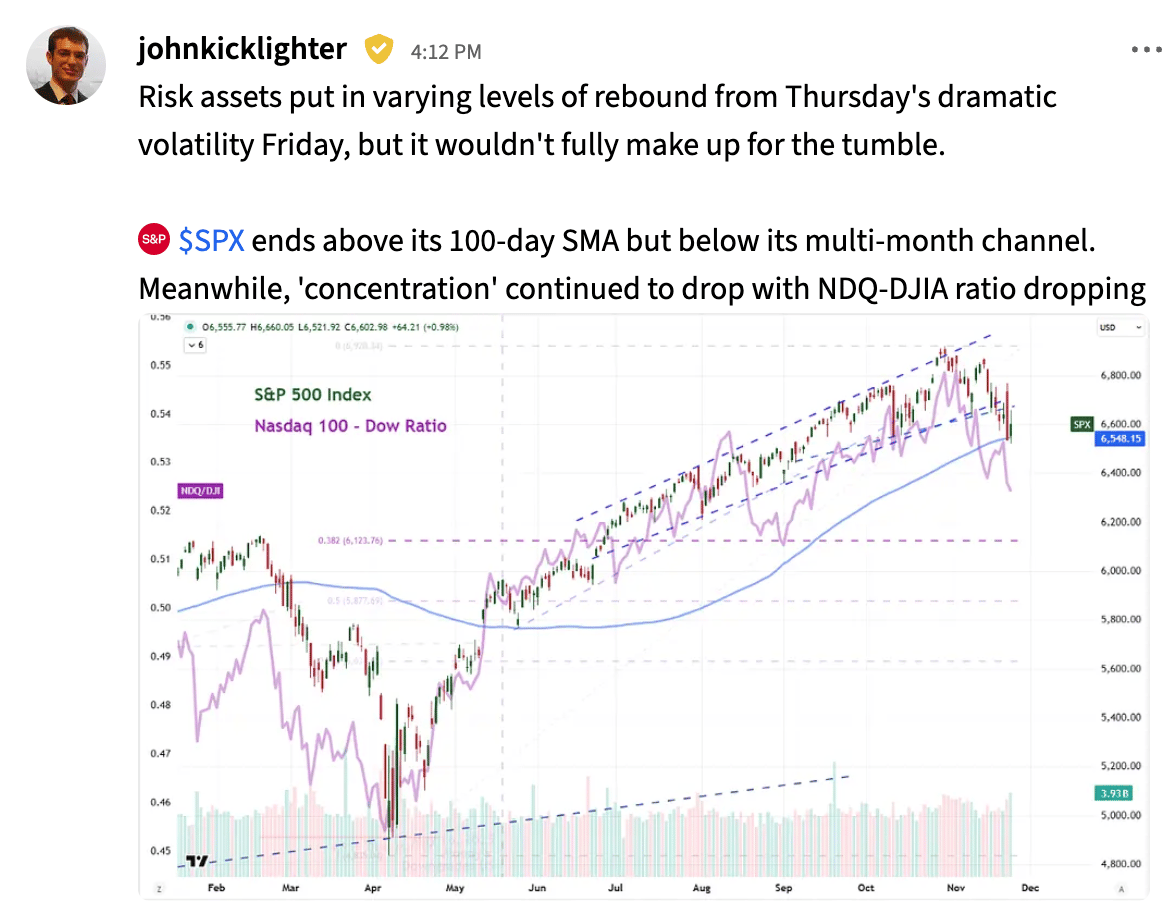

SPX Closes Above 100SMA At 6,548 But Stays Below Multi-Month Channel As NDQ/DJI Ratio Slips Toward 0.45 ⚖️

Get In Touch 📬

How did we do today? |

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach thousands of chart enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋