- Chart Art

- Posts

- Stocktwits Chart Art: April 12, 2024

Stocktwits Chart Art: April 12, 2024

The best charts and trade ideas from the day.

STOCKTWITS CHART ART: APRIL 12, 2024

The Stocktwits Summary 📝

Rate cut concerns, weaker-than-expected bank earnings, and heightened Middle East tensions allowed bears to continue pouncing on risk assets, with most closing down on the day (and week). 🔻

Here’s how the major indexes ended the day:

Index | ST Sentiment Score | ST Message Volume |

|---|---|---|

$SPY (-1.38%) | Bearish (33) | High (64) |

$QQQ (-1.59%) | Bullish (62) | High (63) |

$IWM (-1.78%) | Bullish (55) | High (55) |

$DIA (-1.21%) | Neutral (45) | High (69) |

*The ST Sentiment Score & Message Volume scales range from 0 to 100 (extremely bearish to extremely bullish). More info here.

And here were Stocktwits’ top Trending symbols:

CHART OF THE DAY

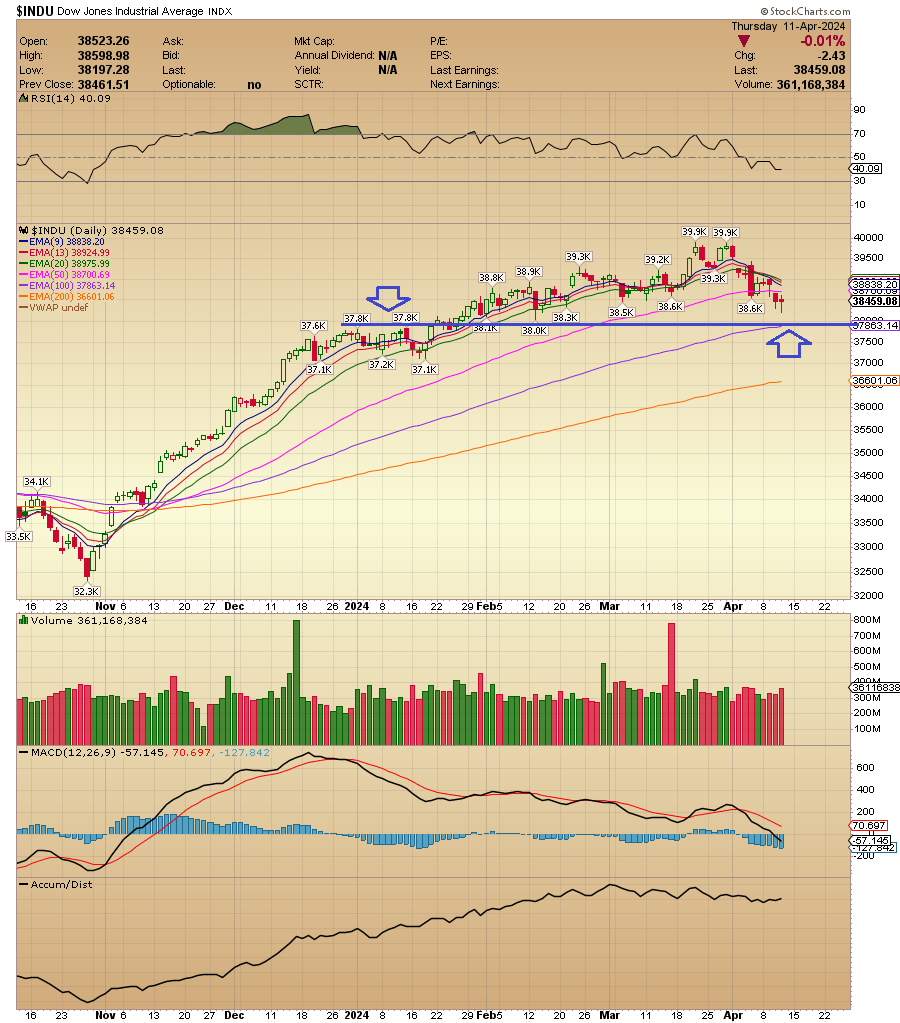

Moving Averages Present Potential Support Levels 🛡️

With the stock market’s tape turning red this week, traders and investors are looking for signs that the decline is slowing before they dip their toes back into the water. 🕵️♂️

One of the most basic tools being employed is a moving average across commonly tracked timeframes, such as 20 days, 50 days, 100 days, and 200 days.

With many of the major indexes already below their 50-day moving average, @ACInvestorBlog is looking at the 100-day moving average and former support/resistance levels and eying a potential bottom into next week. 👀

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach thousands of chart enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍