- Chart Art

- Posts

- Stocktwits Chart Art: April 29, 2024

Stocktwits Chart Art: April 29, 2024

The best charts and trade ideas from the day.

STOCKTWITS CHART ART: APRIL 29, 2024

The Stocktwits Summary 📝

Market volume remains muted, with stocks coming under pressure late in the session but closing green. Big tech earnings, the Fed’s interest rate decision on Wednesday, and U.S. employment data are keeping investors and traders on edge this week. 😬

Here’s how the major indexes ended the day:

Index | ST Sentiment Score | ST Message Volume |

|---|---|---|

$SPY (+0.35%) | Bearish (36) | Normal (45) |

$QQQ (+0.41%) | Neutral (46) | Normal (45) |

$IWM (+0.79%) | Bearish (27) | Normal (47) |

$DIA (+0.39%) | Neutral (52) | Low (35) |

*The ST Sentiment Score & Message Volume scales range from 0 to 100 (extremely bearish to extremely bullish). More info here.

And here were Stocktwits’ top Trending symbols:

CHART OF THE DAY

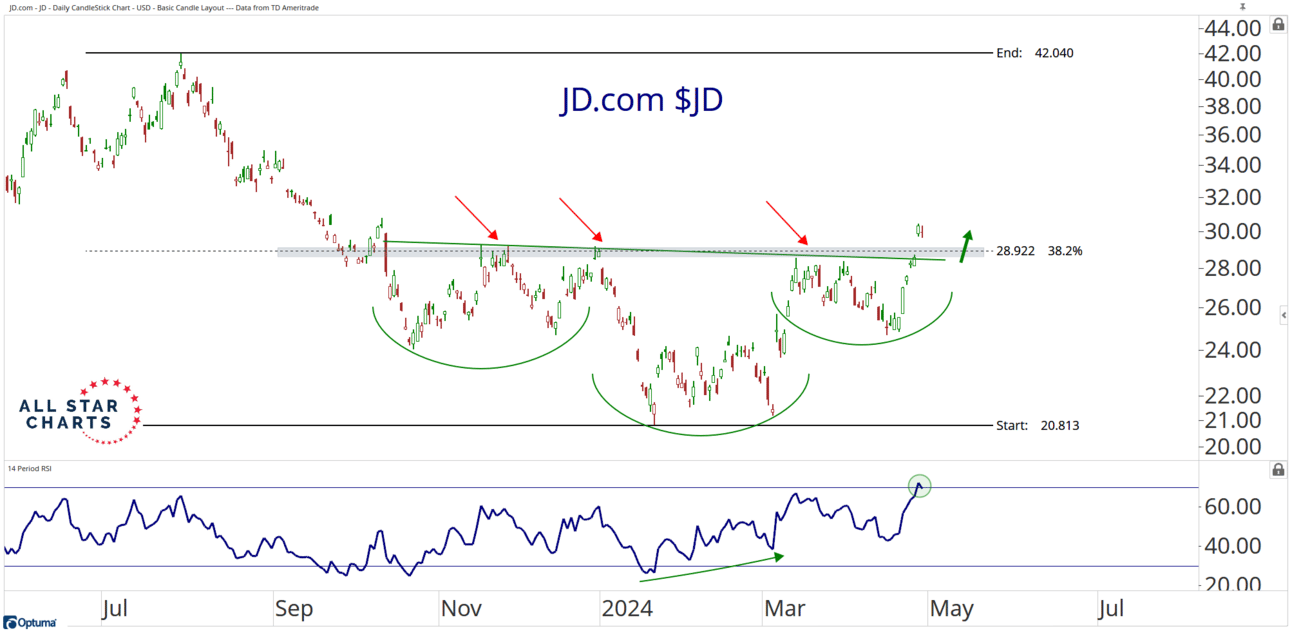

JD’s Jump Puts Chinese Stocks Back On The Map 📍

Chinese stocks were more or less left for dead in 2023 after the country’s post-COVID reopening failed to deliver on the economic rebound investors had expected. Given almost every other country’s stock market was trending higher and geopolitical tensions between the West and China were heating up, there was little reason for investors to sit through the underperformance. 😢

However, as we’ve pointed out, the country’s stock market indexes and major companies have been quietly rebounding in 2024 and are beginning to catch investor attention.

Stocktwits user @OptionsSean pointed out the recent breakout and improving momentum picture for JD .com, one of the largest B2C online retailers in the country. Sean notes that although the recent move has been slow and steady, sentiment towards the space could really shift quickly if prices start to exhibit some sustained absolute and relative momentum. 🤩

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach thousands of chart enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍